1031 Exchange

What is a 1031 Exchange?

Key Components of 1031 Exchange

There are numerous ways to sell your current investment property and fund your next real estate investment. One method that defers taxes on real estate is a 1031 exchange. Essentially, you are taking the equity of one property and exchanging it for new properties.

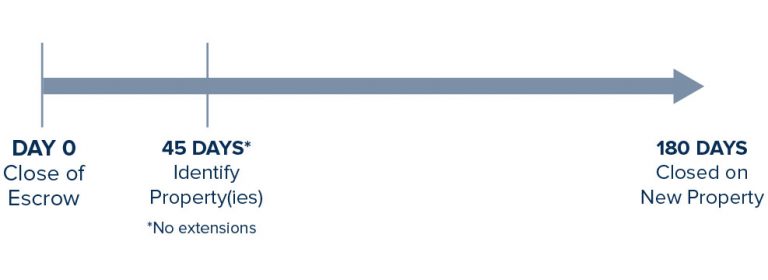

One of the most important aspects to properly executing a 1031 exchange is timing. After you’ve sold a property, you have 45 days to identify replacement properties and 180 days to close. This is a short timeframe that Cherrypick Holdings can make!

Benefits of a 1031 Exchange

Taxes

Most investors look toward the 1031 exchange for a means to defer taxes paid on selling their real estate investment.

Income

By using the capital from the sale, you can purchase a larger real estate opportunity and produce more income.

Diversification

By taking the proceeds and investing it into several real estate opportunities, you add more diversification to your portfolio.

Types of Real Estate

The IRS stipulates that the replacement investment properties must be “like kind” and to take full advantage of the tax deferral, you should buy new investment properties of equal or greater value. HomeUnion supplies you with a full portfolio to ease this process.

How It Works

Step 1. Schedule an Introductory Call

We discuss your goals, answer your questions, and send you a sample portfolio of properties.

Step 2. Meet with Our Exchange Partner

We quickly introduce you to 1031 exchange partners who can review

the transaction with you and your tax and/or legal advisors.

Step 3. Sell Your Relinquished Property

Once you sell your property and it goes under contract, our 1031 exchange partners will help you start the exchange

Step 4. Receive Your Custom Portfolio

During the selling phase, Cherrypick Holdings sends you a custom portfolio of available cash flow properties that match your goals.

Step 5. Approve Your Properties

Since you will have a strict time-frame, you should finalize which Cherrypick properties you’re moving forward with.

Step 6. Sit Back & Relax

Our 1031 exchange partners do all the legwork for you to close on your relinquished property. All you have to do is sign! Our team handles all the details of acquiring your properties and applying the proceeds to complete the exchange.

Step 7.

Congratulations. You just sold your real estate investment tax-free, and now own real estate properties in growing markets.